Featured

Money Laundering Fines Fca

The idea of cash laundering is essential to be understood for these working in the monetary sector. It's a process by which soiled cash is converted into clear cash. The sources of the cash in precise are prison and the money is invested in a manner that makes it appear like clear cash and hide the identification of the prison a part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the new clients or sustaining present clients the duty of adopting enough measures lie on each one who is a part of the group. The identification of such ingredient to start with is simple to take care of as an alternative realizing and encountering such situations in a while in the transaction stage. The central financial institution in any country gives full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such situations.

The failings were serious and lasted for more than three years. The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide.

Leading Nigerian bank in the UK Guaranty Trust Bank UK Ltd GT Bank or GTB has been found guilty of regulatory breaches in its money laundering procedures by the UKs Financial Conduct Authority FCA.

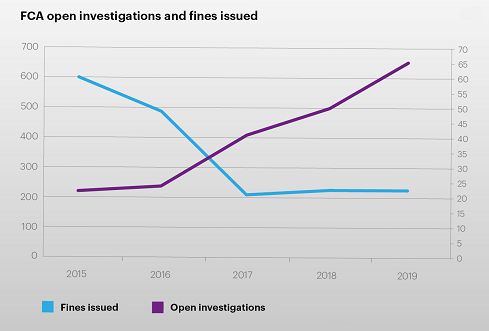

Money laundering fines fca. The Financial Conduct Authority FCA has halted half of its money laundering investigations in 2020. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017.

The FCA issued a record number of fines in 2019. FCA Penalty to Commerzbank. The fine is one of the largest handed out by the regulator in relation to money-laundering failures.

The financial watchdog found the bank in breach of core principles. The lender could face unlimited fines if it is found guilty of breaching the FCAs anti-money laundering rules which have yet to be tested in UK courts. The data comes from freedom of information request by law firm Eversheds Sutherland.

The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank. Since 2002 Asian regulators have imposed 155 billion in fines and Oceanian regulators have imposed 7001 million but Latin American 337 million and African 13 million regulatory bodies have traditionally lagged behind. Last year HMRC announced a 78 million fine against a London MSB that ignored anti-money laundering regulations.

FCA Fines Nigerian Bank GTB for Lapsed Money Laundering Controls. 22 rows This contains information about fines published during the calendar year. The Financial Conduct Authority FCA fined Commerzbank 38 million for money laundering failures including its out of control system to control customers.

The bank has become the first to face criminal proceeding under the UKs 2007 Money Laundering Regulations MLR. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of. There were no anti-money laundering fines issued by regulators in Asia Africa Latin America or Oceania in 2019.

Standard Chartered was fined 102m by the FCA in April 2019 for similar issues although that. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules. FCA said the German business bank failed to meet money laundering controls despite three separate warnings for.

The Financial Conduct Authority FCA has fined EFG Private Bank Ltd EFG 42 million for failing to take reasonable care to establish and maintain effective anti-money laundering AML controls for high risk customers. We have fined the firm 873118. Any fines paid by the lender would go to.

Further information on managing money-laundering risk. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws.

It shows the regulator stopping seven of its 14 investigations into money laundering since January. In March 2021 The Financial Conduct Authority FCA announced that it was launching criminal proceedings against NatWest one of the largest banking groups in the UK for allegedly failing to prevent money laundering in line with Money Laundering Regulations 2007. FCA fines Commerzbank London 37805400 over anti-money laundering failures FCA.

FCA Fine for Anti-Money Laundering Failings Posted on 17 June 2020 The FCA has fined Commerzbank AG London Branch Commerzbank 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017 the Relevant Period. The FCA has today fined Commerzbank AG London Branch 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017.

Fca Fines Sapien Capital For Cum Ex Trading Financial Crime Control Failings Fintech Global

German Bank Fined 37 8m For Anti Money Laundering Failings International Adviser

Priorities And Trends In Fca Enforcement Where Should Firms Direct Their Resources Finance And Banking Uk

Record Breaking Fines On Banks For Kyc Aml Non Compliance

Financial Conduct Authority Fca Aml Fines Sanction Scanner

Fsm Fca Fines Commerzbank London 37 805 400 Over Anti Money Laundering Failures

Fca Fines Canara Bank 896 100 For Aml Failings

Fca Fines Commerzbank London For Aml Failings Pymnts Com

Fca Fines London Boutique Investment Bank For Failing To Spot Financial Crime Relating To Cum Ex Trading Cityam Cityam

Fca Fines Deutsche Bank 163 Million For Serious Anti Money Laundering Controls Failings Planet Compliance

Uk Watchdog S Fines Against Insurers Banks Drop By 75 In 2018

Demystifying The Fca S Demands A Detailed Guide For The Uk S Aml Requirements Sumsub Com

The world of laws can look like a bowl of alphabet soup at instances. US money laundering regulations are not any exception. We now have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm focused on defending monetary companies by reducing risk, fraud and losses. We now have huge financial institution expertise in operational and regulatory danger. We now have a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse consequences to the organization as a result of risks it presents. It will increase the chance of major risks and the opportunity value of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment